Understanding bank statements is crucial for managing personal finances effectively. This guide focuses on the section of bank statements that displays bank service charges, providing insights into their purpose, types, and strategies for minimizing them. By delving into receive bank statement showing bank service charge, we aim to empower readers with the knowledge to make informed decisions and optimize their banking experience.

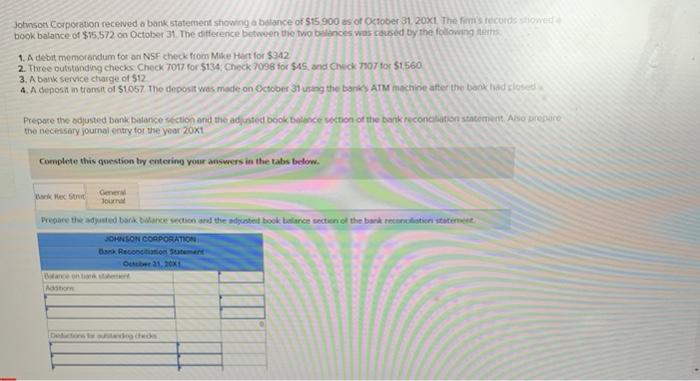

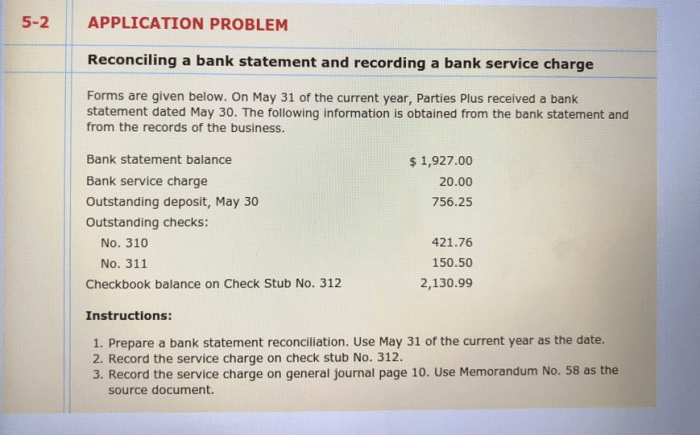

Bank statements serve as detailed records of financial transactions, including deposits, withdrawals, and service charges. These charges, typically found in a dedicated section of the statement, represent fees levied by banks for providing various services, such as account maintenance, overdraft protection, and foreign currency exchange.

Overview of Bank Statement

A bank statement is a document issued by a bank to its customers, providing a summary of financial transactions over a specified period. It includes details such as deposits, withdrawals, and any other charges or fees.

The section where bank service charges are typically displayed varies depending on the bank and the format of the statement. However, it is usually located towards the bottom of the statement, under a heading such as “Service Charges” or “Fees.”

Identifying Bank Service Charges: Receive Bank Statement Showing Bank Service Charge

Bank service charges can be identified by looking for line items on the statement that have a negative value and are not associated with a specific transaction.

Common types of bank service charges include:

- Monthly maintenance fees

- Overdraft fees

- Foreign transaction fees

- ATM withdrawal fees

- Paper statement fees

Understanding Bank Service Charges

Banks impose service charges to cover the costs associated with providing banking services, such as maintaining accounts, processing transactions, and providing customer support.

The amount of service charges can vary depending on the type of account, the number of transactions, and the bank’s policies.

Minimizing Bank Service Charges

There are several ways to reduce or avoid bank service charges:

- Choose an account with low or no monthly maintenance fees.

- Limit the number of transactions you make each month.

- Avoid using ATMs that charge withdrawal fees.

- Sign up for electronic statements instead of paper statements.

- Consider switching to a bank that offers lower fees.

Record Keeping and Dispute Resolution

It is important to keep records of your bank statements to track service charges and identify any unauthorized or incorrect charges.

If you believe a service charge is incorrect or unauthorized, you should contact your bank immediately to dispute the charge.

Expert Answers

What is the purpose of bank service charges?

Banks impose service charges to cover the costs associated with providing various services, such as account maintenance, overdraft protection, and foreign transaction processing.

How can I identify bank service charges on my statement?

Bank service charges are typically displayed in a dedicated section of the statement, often labeled as “Service Charges” or “Bank Fees.”

What are some common types of bank service charges?

Common types of bank service charges include monthly maintenance fees, overdraft fees, foreign transaction fees, and ATM withdrawal fees.

How can I minimize bank service charges?

To minimize bank service charges, consider choosing accounts with low or no monthly fees, avoiding overdrafts, using in-network ATMs, and exploring alternative banking options with lower fees.